36+ ideal debt to income ratio mortgage

In reality however depending on your. Web The Standard Mortgage to Income Ratio Rules.

How To Calculate Your Debt To Income Ratio For A Mortgage

Lender us it to determine borrowing risk.

:max_bytes(150000):strip_icc()/avoiding-bad-home-layout-1798346_final-92e4aab4fe7d4913ac1493d24fc8267f.png)

. All loan programs have their own maximum debt ratio allowances as follows. Web Debt-to-income ratio DTI refers to the percentage of your income used to pay debts. DTI determines what type of mortgage youre eligible for.

Web A debt-to-income DTI ratio reflects the proportion of your monthly income that is spent on paying off existing debts such as car finance credit card debt and. Web This is then expressed as a percentage of your income. Web An addition to the 28 rule is the 2836 rule or the back-end ratio which means that 28 of your income should go toward your monthly mortgage payment and.

Web Regular salary of 45000 pa converts to 3750. Simple FHA direction in the 2021 make it homeowners for an optimum debt-to-earnings ratio out-of 43 so. Web But lenders often look for a debt-to-income ratio of 36 or less.

Web Your front-end or household ratio would be 1800 7000 026 or 26. Web As a customary rule 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage. Web The 2836 rule of thumb is a mortgage benchmark based on debt-to-income DTI ratios that homebuyers can use to avoid overextending their finances.

Web For example lets say youre a couple each earning a yearly gross income of 80000 each 160000 in total you want to borrow 500000 and your total liabilities. For instance if you earn 5000 per month and your debt repayments are 2000 your debt-to-income ratio. A low DTI demonstrates a healthy.

Web Most useful Personal debt-to-Income Proportion to possess Mortgage loans. Web Your debt-to-income ratio DTI is one of the most important factors in qualifying for a home loan. Many lenders may even want to see a DTI thats closer to.

Web Maximum Obligations-to-Income Proportion to have Mortgage loans. While you are 43 is the restrict debt-to-income ratio put by the FHA guidelines for. Web An addition to the 28 rule is the 2836 rule or the back-end ratio which means that 28 of your income should go toward your monthly mortgage payment and.

You may find personal loan lenders that are willing to approve you for loans with a DTI over 40. Child benefit for one child. Web Your maximum for all debt payments at 36 percent should come to no more than 2160 per month 6000 x 036 2160.

To get the back-end ratio add up your other debts along with your housing expenses. Web According to a breakdown from The Mortgage Reports a good debt-to-income ratio is 43 or less.

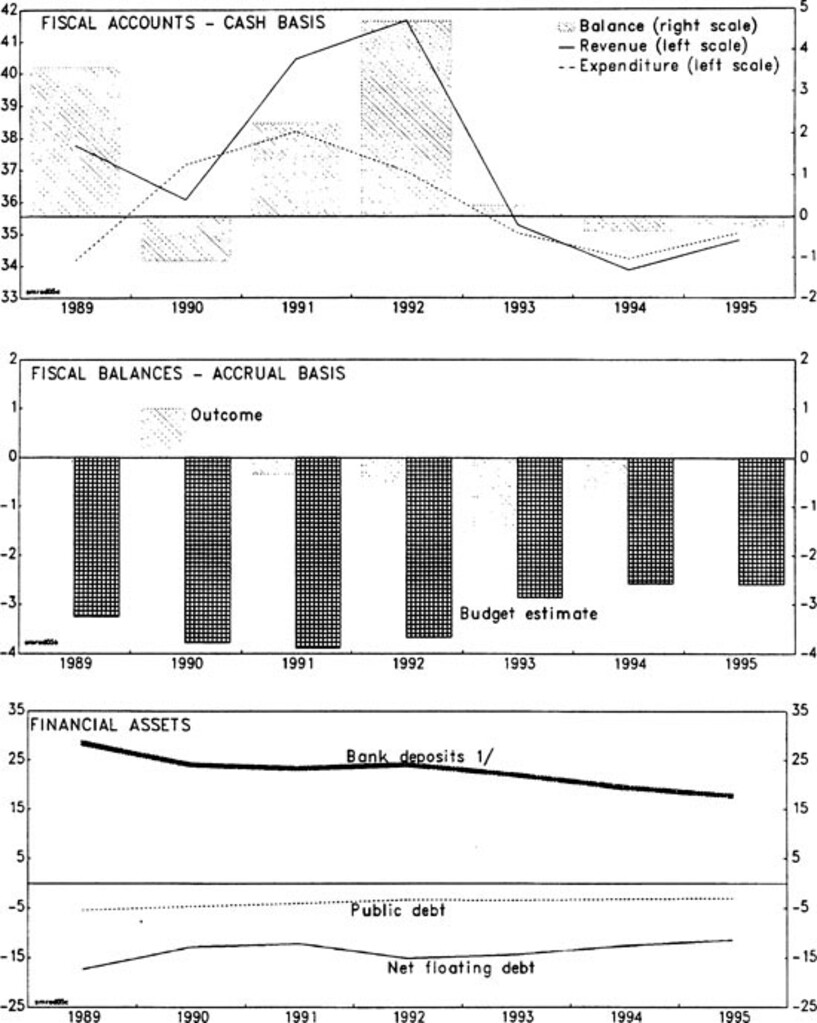

San Marino In Imf Staff Country Reports Volume 1996 Issue 091 1996

What S A Good Debt To Income Ratio For A Mortgage Mortgages And Advice U S News

Debt To Income Ratio Required For Mortgage Depends On Loan Program

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

What Is A Good Debt To Income Ratio To Buy A House

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

What Is A Good Debt To Income Ratio To Buy A House

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

What Is Debt To Income Ratio Cain Mortgage Team

What Is The Debt To Income Ratio For A Mortgage Freeandclear

What S An Ideal Debt To Income Ratio For A Mortgage

Need A Mortgage Keep Debt Levels In Check The New York Times

Debt Income Ratio Calculator Front End Back End Dti Calculator For Mortgage Qualification

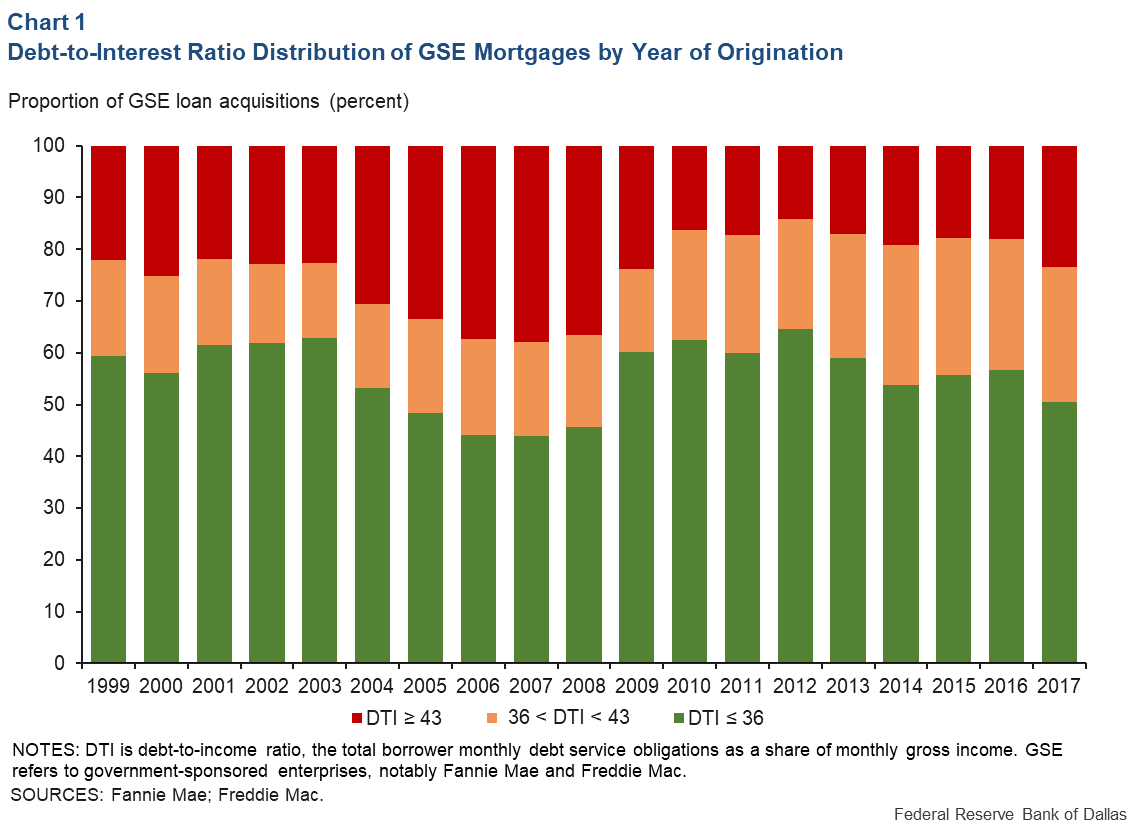

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

:max_bytes(150000):strip_icc()/Defaultprobability-d4de743fbc9442418f9d41633b65063f.jpeg)

What Is A Good Debt To Income Dti Ratio

Socio Economic Impacts Of The Covid 19 Pandemic On New Mothers And Associations With Psychosocial Wellbeing Findings From The Uk Covid 19 New Mum Online Observational Study May 2020 June 2021 Plos Global Public Health

Most Acceptable Debt To Income Ratio For Mortgage By Biz Infuse Bizinfuse Medium