30+ 15yr fixed mortgage calculator

A 30-year mortgage is structured to be paid in full in 30 years. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

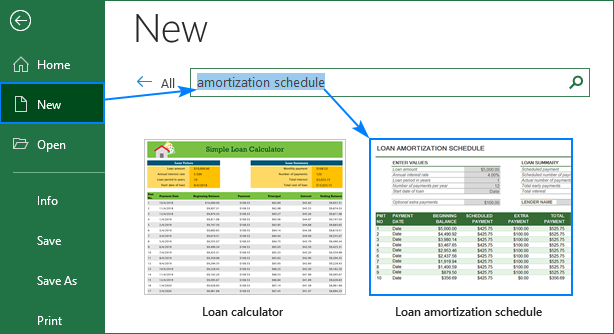

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

In the drop down area you have the option of selecting a 30-year fixed-rate mortgage 15-year fixed-rate mortgage or 51 ARM.

. 392 rows Youll pay a total of 18291055 in interest costs with a full 30-year fixed mortgage. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Ad Connect with a reverse mortgage lender now to see if you qualify with a free consultation.

The average 15-year fixed and. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. The calculator will also create an amortization table for both the 15- and 30-year loans so you can do a side-by-side comparison of how fast youll pay the loan down on each and what your.

30 year mortgage is the interest rate. The average 15-year fixed mortgage rate is 485 an increase from the prior week according to Freddie Mac data. Ad Compare Top Mortgage Refinance Lenders.

Monthly payments on a 15-year fixed mortgage at that rate will. Find A Great Lender Today. A handful of closely followed mortgage rates climbed up today.

A Perfect Option For Long-Term Home Owners. Its Never Been A More Affordable Time To Open A Mortgage. 30 year calculator 20 year fixed mortgage.

15-Year Or 30-Year Fixed Mortgage Calculator 15-year vs. 7 hours ago30-year fixed mortgage rates. One of the major differences in a 15 vs.

The interest rate is lower on a 15-year mortgage and because the term is half as long youll pay a lot less interest over the life. A 15-year mortgage will save you money in the long. Ad Get Info Tips On Which Mortgage Or Home Loan Option Is Best For You.

2 days agoThe average rate for a 15-year fixed mortgage is 525 percent up 17 basis points since the same time last week. This type of 15-year. Choosing Between a 15-Year Fixed-Rate Mortgage and a 30-Year Fixed-Rate Mortgage Buying a house is a huge decision that requires long-term planning and budgeting.

Last week this rate was at. The first two options as their name indicates are fixed-rate. Last week this rate was at 455.

Our calculator lets you play around with key factors that go into your monthly mortgage costs such as. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. The 30-year fixed-rate loan is the most common term in the United States but as the economy has went through more frequent booms busts this century it can make sense to.

Since a 15 year mortgage means the bank will be getting its money back so much sooner theyre able to. The current average 30-year fixed mortgage rate is 566 according to Freddie MacThis is an increase from last week when it was at 555. House price down payment amount and interest rate.

2 days ago15-year fixed-rate mortgages. The average interest rate for a 15-year mortgage is currently 523 compared to the 30-year mortgage rate of 603. Schedule A Call Or Get A Quote Online Today.

31 2022 600 am. 15 Year Fixed Mortgage Calculator - If you are looking for suitable options then our comfortable terms are just what you are looking for. 30-year mortgage There are pros and cons to both 15- and 30-year mortgages.

View todays current mortgage rates with our national average index calculated daily to bring you the most accurate data when purchasing or refinancing your home. The average rate for a 15-year fixed mortgage is 525 which is an increase of 17 basis points from the same time last week.

86 Of Americans Cannot Answer These Basic Financial Questions Can You Begin To Invest

Your Adjustable Rate Mortgage Needs To Be Refinanced

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Should You Pay Off A Mortgage Early Part Ii Charts And Graphs

Should You Pay Off A Mortgage Early Part Ii Charts And Graphs

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Your Adjustable Rate Mortgage Needs To Be Refinanced

I Have Presently Have A 4 125 30 Year Mortgage And I Was Thinking About Going Into A 15 Year Mortgage At Roughtly 3 0 I Wanted To Hear Your Toughts For The Pros Cons About Doing This Modification Quora

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

Should You Pay Off A Mortgage Early Part Ii Charts And Graphs

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

86 Of Americans Cannot Answer These Basic Financial Questions Can You Begin To Invest

What Are Some Of Ideas You Can Use To Pay Off Your Mortgage Quicker Quora

Mortgages 101 An Introduction To Interest Rates Infographic Mortgage Tips Home Mortgage Real Estate Tips